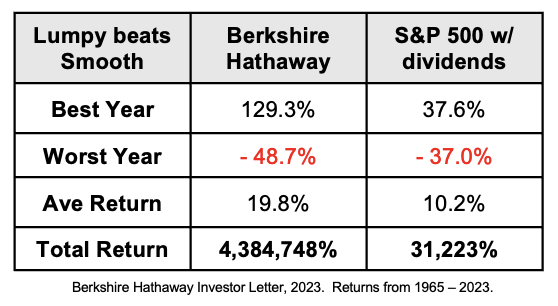

Lumpy Returns Beat Smooth

Why a Lumpy Higher Return Over Time Beats a Smooth Lower Return

Investors often face the dilemma of choosing between investments that offer higher but volatile returns and those that provide lower but more stable returns. The consensus among many financial experts is that over the long term, a lumpy higher return tends to outperform a smooth lower return. Let’s delve into why this is the case, supported by mathematical examples and research findings.

The Nature of Volatility and Returns

Volatility refers to the degree of variation in the price of an investment over time. While high volatility can be nerve-wracking, it is often associated with higher returns. According to Warren Buffett, "Charlie and I would much rather earn a lumpy 15% over time than a smooth 12%," emphasizing that the discomfort of volatility is often compensated by higher gains in the long run.

Warren Buffett, “Charlie and I would much rather earn a lumpy 15% over time than a smooth 12%.”

A study by the CFA Institute found that high-volatility funds in the U.S. delivered an annualized return of 15.89% over ten years, compared to just 5.16% for low-volatility funds. This trend was consistent across international and emerging markets, where high-volatility funds also outperformed their low-volatility counterparts (CFA Institute) (click here to read the report: Oakmark Funds).

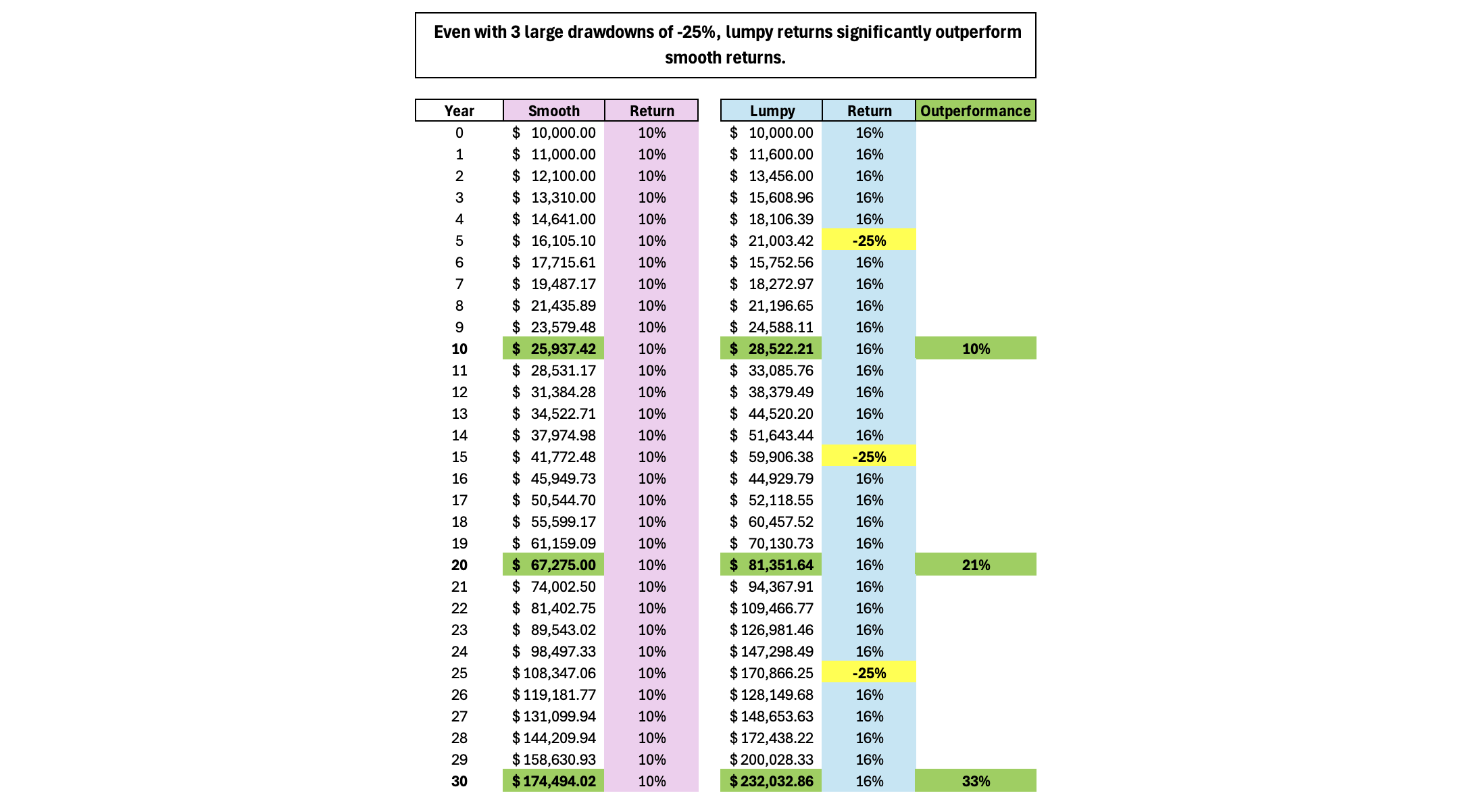

Mathematical Illustration

Consider two investment options:

Investment A: Offers a smooth return of 10% per year.

Investment B: Offers a volatile return, averaging 16% per year but with three significant drawdowns of -25% each.

Assuming an initial investment of $10,000, after 30 years, the outcomes would be:

Investment A: $10,000 —> $174,494

Investment B: $10,000 —> $232,033

Even with the ups and downs, including three -25% years, Investment B significantly outperforms Investment A by 33% over the long term.

The Psychological Aspect

Many investors prefer smooth returns due to the psychological comfort of stability. However, focusing too much on avoiding volatility can lead to suboptimal investment strategies. As noted by Howard Marks of Oaktree Capital, reducing volatility often means sacrificing higher potential returns, which might be a suboptimal strategy for long-term investors who can withstand short-term fluctuations (Oaktree Capital) (Oakmark Funds).

Risk and Reward Trade-off

While high volatility can lead to higher returns, it also comes with increased risk. It is crucial for investors to assess their risk tolerance and investment horizon. For long-term investments, the potential for higher returns can outweigh the discomfort of short-term volatility. On the other hand, investors with a shorter time frame or lower risk tolerance might prefer the stability of lower-volatility investments.

Our View

In the long run, investments that offer higher, albeit lumpy, returns tend to outperform those with smooth but lower returns. The key is to understand and manage the associated risks while keeping a long-term perspective. History, research, and mathematical models show that embracing volatility can lead to significantly higher wealth accumulation over time.

For further reading and detailed analyses, please refer to sources like the CFA Institute and Oaktree Capital, which provide in-depth discussions on this topic.

References: