Research Report: Robinhood (HOOD)

Overview

Robinhood Markets, Inc. (NASDAQ: HOOD) is a financial services platform best known for pioneering commission-free trading and disrupting the traditional brokerage industry. Since its founding in 2013, the company has aimed to democratize finance for all, making investing more accessible to retail investors. With a mobile-first interface, simple UX, and a wide product range spanning stocks, ETFs, options, crypto, and cash management, Robinhood has become a go-to platform for millions of retail traders.

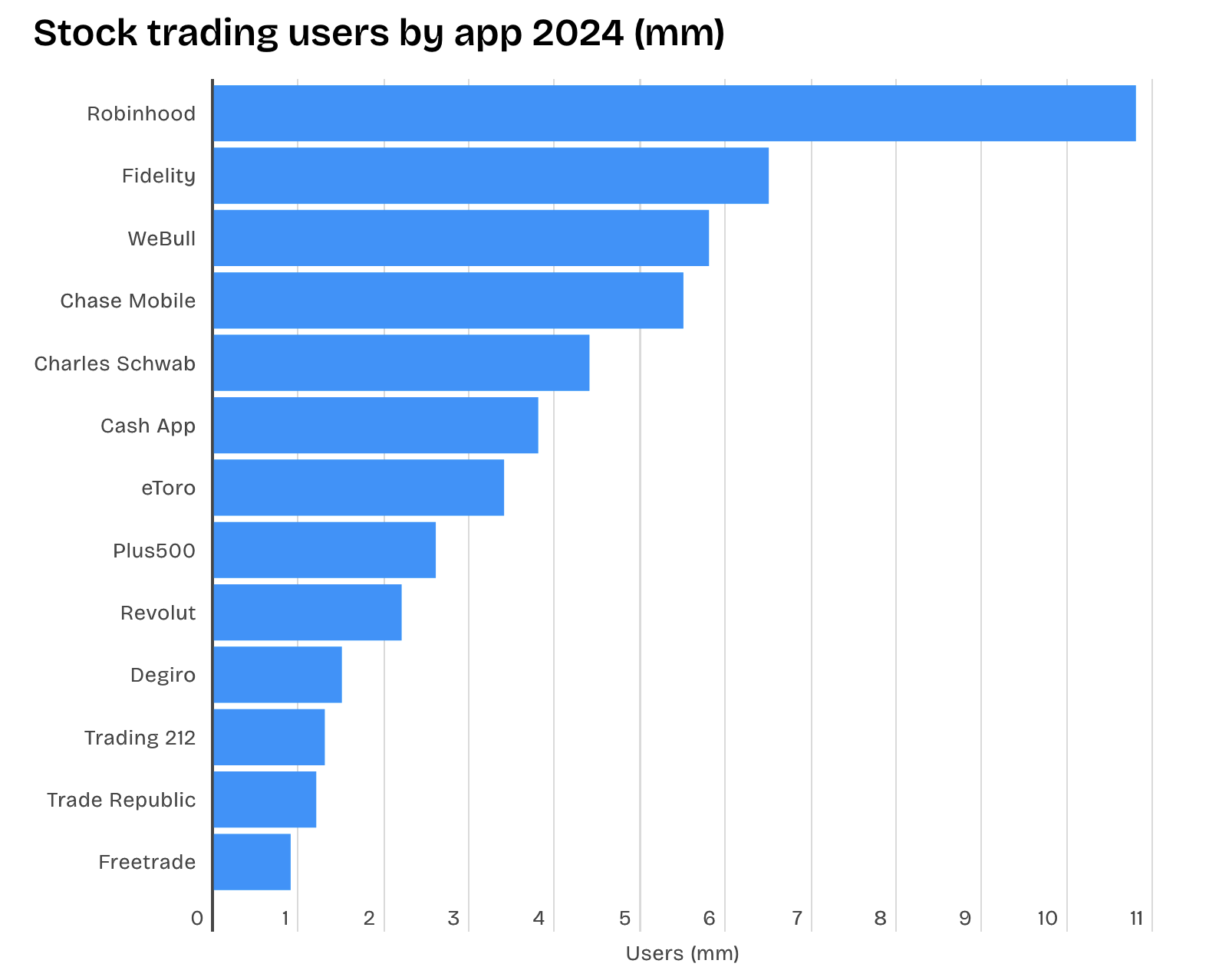

Market Position and Growth

As of Q2 2025, Robinhood has over 25 million funded accounts and continues to serve a predominantly retail user base. The firm has been expanding its product suite to improve customer retention and increase monetization per user, including the rollout of retirement accounts, advanced trading tools, and a recently launched credit card. International expansion began in earnest with the launch of brokerage services in the U.K. in late 2024, and additional EU markets are expected later this year. The company has also deepened its penetration into digital assets, acting as both a crypto custodian and trading venue.

Impressive top line growth

Robinhood's revenue has seen significant growth in recent years, with a 5-year revenue CAGR of 81.28%

Technological and Strategic Differentiators

Robinhood's strength lies in its simplicity, brand appeal, and vertically integrated tech stack. Unlike many legacy brokers, Robinhood controls its user interface, back-end clearing operations, and order routing mechanisms through its wholly owned subsidiary, Robinhood Securities. This gives the firm greater control over trade execution quality and costs. The company has also invested in AI-driven customer service and fraud prevention tools, enhancing both scalability and security. Its crypto wallet and staking features appeal to the digital-native demographic and support cross-asset engagement on the platform.

Key Developments and Strategic Moves

One of the most significant recent developments was Robinhood’s acquisition of Bitstamp, a global cryptocurrency exchange with strong institutional relationships. This move marks a strategic pivot toward international growth and broadens the firm's crypto footprint beyond retail. In parallel, the firm has steadily improved its net interest income through higher yields on customer cash balances, benefiting from the higher-for-longer interest rate environment. Robinhood has also been expanding its Gold subscription tier, which now includes research, Level II market data, and higher margin limits—all of which enhance monetization and engagement.

Financial Performance

In Q1 2025, Robinhood reported revenue of $618 million, up 24% YoY, driven by net interest revenue and transaction-based revenue from both equities and crypto. Monthly Active Users (MAUs) stabilized at around 12.3 million, while Average Revenue Per User (ARPU) rose to $95. The company reported positive adjusted EBITDA for the third consecutive quarter, signaling improving operating leverage. Its balance sheet remains strong, with over $5 billion in cash and no long-term debt.

Risks and Challenges

Despite its growth, Robinhood faces regulatory headwinds, particularly around payment for order flow (PFOF), which still constitutes a meaningful portion of its revenue. Increasing scrutiny from the SEC or legislative changes could impact profitability. Competition is also intensifying from both fintech startups and traditional brokers enhancing their digital offerings. Additionally, crypto volatility introduces earnings variability, and user engagement can be cyclical in nature, driven by macro conditions and market sentiment.

Younger and more engaged users

The average age of Robinhood is 31 years old.

Our View

Robinhood is evolving from a high-growth disruptor into a multi-product financial services platform. While regulation remains a risk, we view its brand strength, user base, and expanding revenue streams as compelling long-term assets. The Bitstamp acquisition gives Robinhood a new foothold in institutional crypto and international markets. If the firm continues to grow ARPU and contain costs, there is meaningful upside from current valuation levels. Robinhood remains one of the most important bellwethers of the retail investing movement and is positioned to benefit from both fintech and crypto secular trends.

Further Reading

Robinhood Q1 2025 Shareholder Letter

SEC Regulatory Proposals on Payment for Order Flow

Bitstamp Acquisition Press Release

Competitive Analysis: HOOD vs. SCHW vs. SOFI